A SWEDISH SMALL CAP IDEA

Situation Overview

ContextVision is an under the radar, market-leading supplier of image-enhancement software for ultrasound equipment which helps clinicians perform more accurate and precise diagnosis. I believe that this situation could offer a 93.4% upside in the next 2 years for an IRR of 39.1%. While the core business has compounded topline steadily at a 6.7% annually since 2010 (excl. FX) it has since 2015 screened poorly due to net-losses and poor results on a group level, from an unmonetized and heavily invested Digital Pathology business. However, a new management entered in mid-2021 and decided to split the company and spin-out the Digital Pathology business. This led to a turnover in the shareholder base and caused shares to de-rate significantly from ~ 25 NOK to ~ 7 NOK. The business is now generating EBIT margins of 33.4%, ROIC’s of ~ 45.0%, has a solid net-cash position, a long runway, and scale advantages, but is still valued like a melting ice-cube on a NTM EV/EBIT multiple of 12. Years of underinvestment in the core business has created long-term opportunities for the new management to deploy capital smartly, return excess cash to shareholders, and continue to grow the business by a conservatively estimated forward CAGR of 6.5% (in line with historical GR’s) until 2025 and beyond.

Business Overview & Brief History

ContextVision was founded in 1983 in Sweden, operates in a small niche, and is a global provider of image-enhancement software to the leading OEM’s for both Ultrasound, X-Ray, and MRI equipment. The Company has 40 + years’ experience of delivering industry leading software and generated 117 MSEK of revenue in 2022. ContextVision is only experiencing competition from its customers’ (OEM’s) different R&D divisions (which has been the case since dawn) and is the sole market-leader with a current market share of ~ 20.0% (according to management). The business model is rather simple. Revenue is generated by selling software licenses for different imaging equipment. One license equals one sale, and one license is needed for each ultrasound machine sold and that license is used during the lifetime of a machine, which on average is 5-10 years, and then a new license is sold. Roughly 70.0% of revenue is generated through the Ultrasound division and the rest is generated through the radiology division. Insiders currently own 22.0% of outstanding shares, down from 50% due to a recent board member resignation (he still owns shares) and the free float is therefore small.

I view ContextVision as a highly attractive business from a return’s standpoint due to its asset light nature with zero fixed assets involved, scale advantages, and ability to generate cash. Margins have the potential to improve over time and with limited competition and price pressure (only stemming from a slightly negative industry structure) a forward ROIC and ROE of ~ 45.0% and ~ 55.0% respectively should be expected. I believe that this situation offers a chance to buy a high quality business at an attractive valuation on next year’s financials, that current management can catalyze a higher valuation by continuing to grow the imaging biz steadily, allocate capital smartly, both to grow revenue and return excess cash to shareholders, and that there could be a long-term story here.

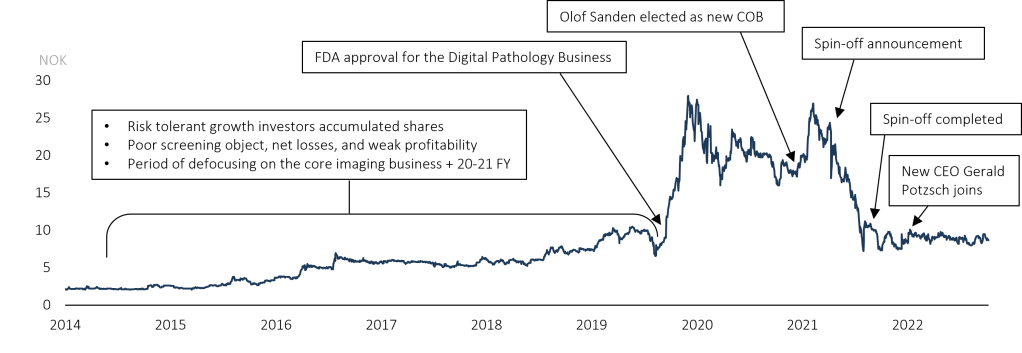

When Olof Sanden joined as the new COB in mid-2021 he immediately decided to split the company in two and give the heavily invested, and so far, unsuccessful, Digital Pathology business, Inify, to existing shareholders as a dividend. This can be seen as his first step in creating shareholder value and a large part of my excitement are about the Company’s new management. Olof said in mid-2021 that “The growth potential from our existing OEM clients is very high, and given Gerald’s (the new CEO) vast experience within that field, we expect great things going forward”. The picture below shows a timeline of major events.

Why do I believe that this mispricing exists? (Classic small cap reasons)

1. The Company is Swedish but listed on a rather unpopular Norwegian stock exchange. Adds a discount.

2. Underfollowed with limited analyst coverage in addition to poor investor relations efforts (no conf calls etc.)

3. Misunderstanding of strong historical performance in the core imaging business, needs some digging to find out.

4. Small Cap with low float: average daily trading volume since spinoff ~ 200 000 SEK. ~ 50% is hold by management.

5. Uncertainty around market-share. Historically communicated to be 90%, but the new management thinks its around 20%

Investment Thesis

New management can act as a driver for value creation

I believe the fact that Olof Sanden was elected as the COB in mid-2021 is overlooked. Only one month in he announced the spin-off of Inify and not long after hired Gerald Potzsch, former head of the cardiology division at Philips, as the new CEO for ContextVision. Olof Sanden brings extensive international med-tech experience to the Company. He was head of business development and VP at Elekta for 13 years, between 2000 to 2013, and during that time Elekta’s share price rose from 2 to 101 SEK per share from its international success, i.e., he was likely part of the value creation. And I believe that the spin-off of Inify was his first step in creating value for ContextVision’s shareholders. The hiring of Gerald Potzsch was a smart move from Olof. Gerald brings valuable experiences to the company from his 17 years at Philips, and he could thus be the right person to run the business and increase the share-of wallet within existing OEM’s, as shown during Q1 23, and he has communicated that the Company is in the early innings of a long-term growth story.

Underinvestment have created potential to continue deploy cash at high rates of return

I believe that years of defocusing on the core business have led to underinvestment and thus created opportunities for the new management team, with skin-in-the-game, to deploy cash at high rates of returns and monetize their software assets more heavily. Between 2014 and 2021, the cost base was composed of 130.9 MSEK towards the Digital Pathology business and only 84.5 MSEK towards the core imaging business. In addition, one can easily assume that a large portion of the historical focus was tilted towards the Digital Pathology biz as the majority of communication in annual reports was centered around that which in turn made it harder to understand performance in the core biz. However, with strong and improved profitability, management can invest both in optimizing their product portfolio and by hiring sales & marketing staff. This could grow their share-of-wallet within current OEM’s and allow for above market growth as seen during Q1 23 when they grew revenue by ~ 15.0% (solely license volume) and communicated that their customers are willing to expand their partnerships for more platforms at the OEM’s.

Based on conservative CAPEX and OPEX estimates the cash buildup could double in two years and account for 65.0% of total assets. That would impel management to increase its current dividend and would return cash to shareholders. With little competition (as of now) I believe a forward ROIC and ROCE in line with 2022 can be expected and is sustainable for the foreseeable future. However, Gerald has said that he would not be surprised if new competition arises due to his understanding of the market potential.

Growth opportunities & operating leverage can drive margins and FCF generation

ContextVision is, with a 10+ years history of growing revenue by 6.5% CARG (excl. FX), entering a phase, where I, based on rather conservative estimates, believe that the Company can deliver HSD growth in the coming years and increase EBIT due to it’s scale advantages and OL with GM’s ~ 95.0%. The traditional ultrasound market is estimated to grow at ~ 5.0% per year until 2026. But the rising hand-held ultrasound market, so called POCUS, is estimated to grow by 20.3% annually until 2026. With a stronger focus on the core business, above historical growth rates which was seen during 2022 and Q1 2023 can be expected. When blending expected growth rates from major OEM’s and one market research provider (Signify), you end up with an annual expected growth rate of ~10.4% until 2026. However, price points for the handheld ultrasound will most likely be lower since those machines comes at a cost of about one third compared to a traditional ultrasound machine. Taking this in consideration, I believe that management could deliver HSD growth rates and return cash to shareholders via dividends.

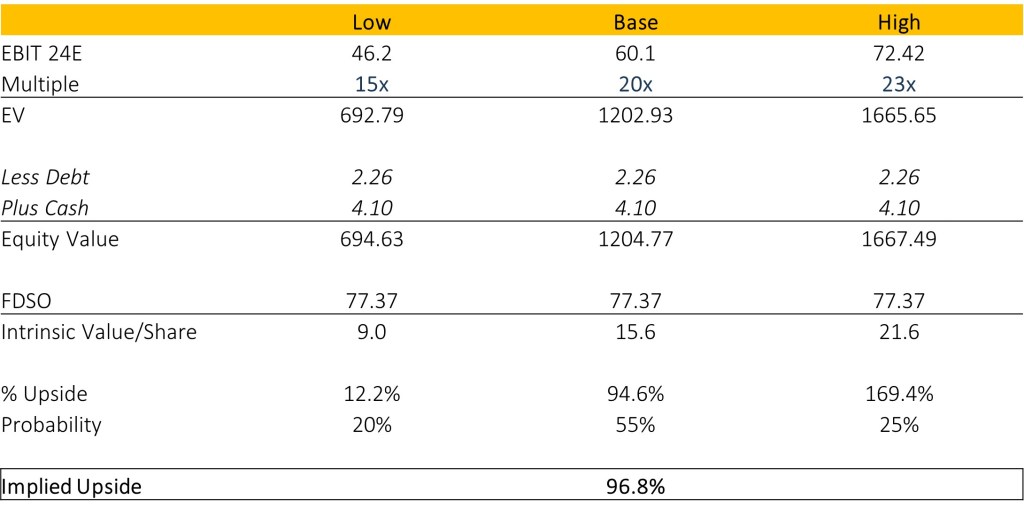

The valuation does not account for current and future state of expected business performance

The Company’s current valuation of 12.0 NTM EV/EBIT does not correspond with the current and future state of expected business performance. For an 8.5% FCF yield, ~35.0% FCF margins, ~33.0% EBIT margins, potentially long-term growth prospects, with returns on capital around the 50s, the business should trade higher.

In a base scenario I think ~ 20 EV/EBIT 2024E is reasonable. The following factors (which one has hopes for) could close the valuation gap and cause shares to re-rate a) Increasing understanding and confidence around the new management team, margins, and financial performance in line with 2022 results b) Initiated sell-side coverage from investment banks such as ABG (who previously interviewed the company) d) Improved IR relation efforts, i.e. implementation of IR function, quarterly conference calls, and financial guidance e) Continuance of cost control and a sought after screening object and f) A potential move to a more popular stock exchange in Sweden were the Company operates (no signs of it so far but a relisting would make a lot of sense).

Business Quality

Switching costs: I believe there is little incentive for OEM’s to switch an image enhancement provider if the company can continue to deliver its high quality software since: 1. Ultrasound and other imaging equipment is highly regulated and needs lengthy safety approvals. Since the Company’s software is integrated early in the value chain new approvals would be needed if software is switched to a new provider, taking this in consideration they are well integrated with their OEM’s. And 2. There is (most likely) a hindrance from the end customer side (hospitals, clinics, and doctors) making a switch less probable as software solutions are tuned and tailored for different customers, there is both an objectively good image quality and a subjectively good image quality. Based on prop research, end customers tend to want to use the same ultrasound style they’ve had before and has a big say when hospitals acquire new equipment. I guess this argument works the other way around, i.e., it makes it harder to grow the share-of-wallet within OEM’s since doctors would be less inclined to switch from their ordinary equipment. However, after interviewing the head of purchasing at a major hospital in Sweden, the degree of imaging quality have strongest impact when they decide to acquire new equipment.

Barriers to Entry: I’m also having a hard time seeing new competitors entering the industry given the limited market size in relation to the required investments for a successful entry. The Company’s software is a result of 40 + years of development from “pioneers within imaging enhancement” and technology is protected by patents which start to expire in 2035. Moreover, the high degree of regulation and approvals involved within Ultrasound and MRI industry will limit new entrants and competition will most likely only span from existing OEM’s R&D divisions (which so far have not been a hinderance for the Company to grow revenue) and long-term relationships + strong “know how” should protect the Company’s market position. I would also add that you need a large amount of data of ultrasound scans, which you get from OEM’s, to build image software and develop competitive products.

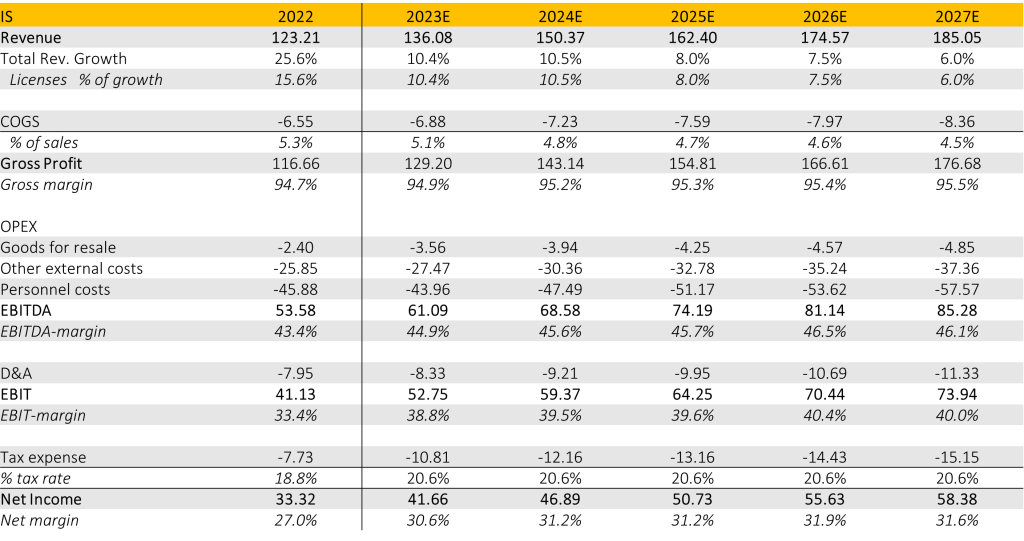

Financials: As previously mentioned, I view ContextVision as a highly attractive business to own given the return profile and ability to improve margins over time from its scale advantages. Business quality is in part evident from the Company’s high returns on capital (which I think is sustainable over the medium/long-term). As shown in the chart below, when adjusting the IS for costs associated with the Digital Pathology business, margins have increased steadily since 2010 and will likely continue to do so as the business grows as there are relatively low capital requirements. And when adding the fact that the Company is debt free and has 45 MSEK in cash on the BS it is an even more attractive business to own.

Financial Summary

Should trade in line with comparable businesses given solid financials & outlook

The Company should trade in line or above comparable businesses given outperformance on every listed metric below, long and solid history within the core imaging business + they are debt free and pays a dividend of 0.30 SEK per share.

The valuation is based on a classic low, base, and high scenario on 2024 EBIT estimates (benchmarked from the comparable businesses abowe) and implies an upside of 97.0% and an IRR of 39.4% if the thesis is realized in two years. I also think there is a chance that management will decide to increase its current dividend since the cash buildup will be significant in a couple of years.

Risks

White labeled software with zero end-customer awareness creates exchangeability risk

The software is sold without requirements for OEM’s to disclose their partnership with ContextVision. This results in a more easily exchangeable product as customers can’t identify their wanted ultrasound style with a brand (which I think is important) However, the Company is riding an outsourcing trend towards third-party solutions, the new management has communicated that actions are being taken to minimize this risk by improving marketing efforts and building end-customer awareness, and historical financials (excl. Inify OPEX) calls for a competitive product offering which have and can yield above industry growth. Furthermore, long-term customer relationships reduces this risk as well.

Other risks

Technology risk is obviously high, hard to determine and assess. However, I believe that the Company is well integrated with their OEM’s and in a much better shape now compared to pre-spinoff since they have all resources centered around the core biz + they were historically able to innovate at a high pace despite the skewed cost base.

Conclusion

1. This situation offers a chance to buy a high quality business with solid financials and high returns on capital at an attractive valuation on NTM EV/EBIT of 12. The new management, with Olof Sanden as COB and Gerald Potzsch as CEO, is here to close that gap and catalyze a higher valuation.

2. Long-term historical growth rates of 6.5% + a blended industry growth rate of 10.4% gives confidence for future revenue growth and FCF generation. In addition to scale advantages, profitability could over the long-term surprise on the upside above my estimates.

3. Investment opportunities, a highly cash generative business, and a strong balance sheet provides management with opportunities to allocate capital smartly. Ideally by launching new products, invest in S&M staff, to grow their share-of-wallet within existing OEM’s and return excess cash via dividends to shareholders.

Catalyst

Except for the above mentioned “catalyst path” in the drivers part, I think strong earnings growth, similar to Q1 23 ~ 15.0% earnings growth (excl. FX) and increased investor awareness would catalyze a higher valuation.

Questions which needs to be addressed: Why does Gerald not own more shares? (Only a tiny 80 000 SEK worth of shares, is he incentivized enough?) How much did the core biz suffer from years of defocusing? Why did the former CEO want to create an entirely new biz instead of focusing on the core? (Which I and the new management believe can generate HSD growth for the foreseeable future) And what opportunities were missed? Answers to these questions would hopefully provide further conviction, or not..

Reach out if you have any questions, a different view, or if you think I’ve got facts or some reasoning wrong. Estimates and other stuff is provided in the appendix below.

All the best!

Appendix